How Banks Exploit Your Psychology

The Hidden Cost of Behavioral Biases in Financial Products

Banks have mastered the art of behavioral manipulation, particularly through complex financial products that appear attractive on the surface but generate substantial profits through investor psychological weaknesses. Research in behavioral finance reveals how financial institutions design “yield enhancement” products to systematically exploit predictable patterns in human decision-making enabling them to extract economic rents caused by cognitive biases (such as yield-chasing and complexity bias). Understanding these tactics is crucial for investors seeking to make rational financial decisions and avoid costly behavioral traps as annual sales of these products reached a historic high at US$149.4 billion in 2024, up 46% from the previous year.

Petra Vokata, author of the July 2025 study “Juicing the Coupon Yield: How Banks Extract Rents from Behavioral Biases” investigated how banks design and sell so-called “yield enhancement products” (YEP: structured products that promise high coupon payments) and how fees on these products are set. She explored the relationship between the advertised coupon rates, the actual net returns investors received, and the behavioral tendencies that banks exploited when marketing these products (which have a global retail market of more than $2 trillion).

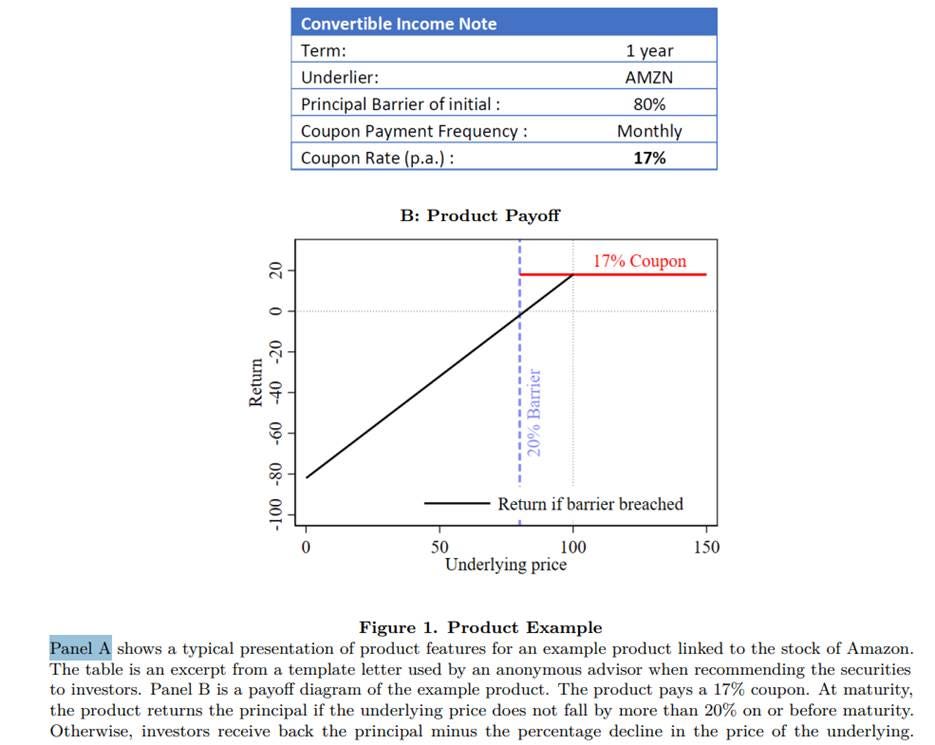

The typical YEP features a coupon representing the annualized yield paid in periodic installments that at first glance, appears attractive—the average coupon in her data was 13%—and a barrier rate (the protection level, principal strike, or trigger price—which determines the extent of downside risk borne by the investor). The expected return of these securities differs from the coupon rate due to an embedded option feature: if the underlying security drops below the barrier rate, the capital payment at maturity is reduced in proportion to the decline in the underlying price. The chart below illustrates a YEP tied to the price of Amazon’s stock. The YEP has a coupon of 17%, the rate which the investor will receive unless Amazon’s prices falls more than 20% on or before maturity. Otherwise, investors receive back the principal minus the percentage decline in Amazon’s stock price.

Vokata hypothesized that retail investors mistakenly overweight the coupon rate while being inattentive to the impact of the option feature on product payoffs. Her dataset covered more than 28,000 securities sold in the U.S. during the period 2006-2015. She began by noting: “A key distinction from typical retail financial products, such as mutual funds or ETFs, is that fees associated with yield enhancement products are not transparently disclosed to investors. Instead, the fees are embedded in the product’s payoff structure, whereby banks charge investors prices above the fair value of the YEPs.”

Key Findings: The Anatomy of Financial Exploitation

Product Design: Issuing banks have virtually unlimited flexibility in designing the securities and often create complex and exotic payoff profiles. Retail investors then must employ sophisticated methods to price path-dependent payoffs to assess the quality of the securities, making the market ripe for the exploitation of behavioral biases.

Illusion of Return, Rising Fees with Higher Coupons:

Higher advertised coupons create the illusion of attractive income. YEPs charged significantly higher fees as the coupon (the headline interest payout) increased. The perverse result was that higher coupons actually predicted both lower expected and lower realized returns.Behavioral Bias—Investor Inattention:

Investors tend to focus on salient attributes like the apparent coupon size and often ignore the shrouded product features such as complex embedded options or high fees—banks cater to investor biases, engineering complex products using exotic, hard-to-value options to make the displayed coupon rates more attractive.Magnitude of Rent Extraction:

Unlike mutual funds or ETFs with transparent expense ratios, YEPs hide their costs in the payoff structure itself. Banks simply charge above fair value—and the more attractive the coupon, the higher the hidden fees. Excess fees related to the put option were substantial—6% per annum average fee—several times larger than excess fees from behavioral biases in other financial products. And for each 1% increase in coupon, fees increased 35 basis points. The next result was that despite the high coupons, the products earned −8.5% return, on average.Alternative Explanations Rejected:

The patterns identified in the study cannot be explained by standard “reaching for yield” theories alone, indicating a clear behavioral component at play.

· When Markets Get Tough, Banks Get Creative: When interest rates fall (making high yields harder to achieve legitimately), banks don’t lower their coupon promises. Instead, they engineer more exotic derivatives that boost advertised yields by making it less likely you’ll receive your principal back—financial engineering at its most cynical.

Vokata’s findings led her to conclude: “Issuers primarily rely on hard-to-value exotic features to construct coupons…. Resulting rents extracted by banks are several times larger than those documented in other financial markets.”

Key Takeaways for Investors

High Coupon Does Not Mean High Returns:

Don’t be seduced by flashy headline coupon rates. These products are often engineered so that apparent yield enhancements mask much higher fees and greater risks.Look Beyond the Marketing:

Structured products with high coupons often use exotic, difficult-to-value derivatives. These boost the yield on paper but rarely translate into higher risk-adjusted returns for the investor.Beware of Hidden Costs: Complexity Hides Them

Banks’ ability to shroud product features means investors can easily overlook embedded fees or unfavorable terms. Always demand a clear breakdown of risks, expected returns, and total costs.Demand Simple and Transparent Investments:

For most investors, simpler, lower-cost investments are likely to deliver better long-term outcomes than complex yield enhancement products with high embedded fees.Behavioral Pitfall—Inattention:

Awareness is a powerful defense. Many investors pay steep “behavioral rents” because they mis-weight salient (headline) and shrouded (hidden product attributes). Take extra care when evaluating structured products that promise high yields.Use Independent Analysis: Rely on fee-only financial advisors who don’t earn commissions from product sales.

Supporting Evidence

In her 2021 study “Engineering Lemons,” covering the period 2006–2015, and more than 28,000 yield enhancement products, Vokata found that while these securities offered attractive yields, they actually provided negative returns. “The products lose money both ex ante and ex post due to their embedded fees. On average, YEPs charge 6–7% in annual fees and subsequently lose 6–7% relative to risk-adjusted benchmarks. Simple and cheap combinations of listed options often dominate yield enhancement products.”

Brian Henderson and Neil Pearson, authors of the 2011 study “The Dark Side of Financial Innovation: A Case Study of the Pricing of a Retail Financial Product”, found that the offering prices of 64 issues of a popular retail structured equity product were almost 8% greater on average than estimates of the products’ fair market values obtained using option pricing methods, and the mean expected return estimate on the structured products was slightly below zero. The authors concluded that the issuing firms either shrouded some aspects of their innovative securities or introduced complexity to exploit uninformed investors.

Geng Deng, Ilan Guedj, Joshua Mallett, and Craig McCann, authors of the August 2011 study “The Anatomy of Principal Protected Absolute Return Barrier Notes,” examined the evidence on ARBNs (absolute return barrier notes)—structured products that guarantee to return the face value of the note at maturity and pay interest if the underlying security’s price doesn’t vary excessively. The principal protection feature guarantees the full payback of the note’s face value at maturity if the investor holds the note to maturity and the issuer does not default. The study covered 214 ARBNs issued by six different investment banks. Most of the products were linked to indexes such as the S&P 500 and the Russell 2000. They found that the ARBNs’ fair price was approximately 4.5% below the actual issue prices. The authors also found that the yields on ARBNs were lower than the corresponding corporate yields. Many were even lower than the risk-free rate!

Carole Bernard, Phelim Boyle, and William Gornall, authors of the study “Locally-Capped Investment Products and the Retail Investor”, found that the contracts were overpriced relative to their fair values by about 6.5% on average.

Geng Deng of Wells Fargo, Tim Dulaney, Tim Husson, Craig McCann, and Mike Yan, authors of the study “Ex Post Structured Product Returns: Index Methodology and Analysis”, analyzed the ex-post returns of more than 20,000 individual structured products issued by 13 leading investment firms from 2007 through 2014. They constructed a structured product index and subindexes for reverse convertibles, single observation (SO) reverse convertibles, tracking securities, and autocallable securities by valuing each structured product in their database each day. Their finding that the average excess fee was 5.9% lead them to conclude: “Results of our index analysis should cause investors and their advisers to avoid structured products.”

Summary

The research on behavioral bias exploitation in financial services provides a reminder that the financial industry doesn’t always align with consumers’ best interests. Banks and other financial institutions have become sophisticated at designing products that exploit predictable patterns in human psychology, often to the detriment of their customers’ long-term financial well-being.

Awareness is the first step toward protection and education is the armor that can protect you from exploitation. The next time a financial professional presents you with a complex product promising superior returns, remember that complexity is often a feature that shrouds downside risk and is designed to extract value from your behavioral biases (such as yield seeking) rather than deliver superior outcomes.

A fitting conclusion comes from the film “War Games.” Joshua (the supercomputer) states: “A strange game. The only winning move is not to play. How about a nice game of chess?”

Larry Swedroe is the author or co-author of 18 books on investing, including his latest Enrich Your Future. He is also a consultant to RIAs as an educator on investment strategies.