Payment-in-Kind, The Pros and Cons of Deferred Income in Direct Lending

What is a Payment-in-Kind (PIK) Loan?

A PIK loan is a loan where the borrower is allowed to make interest payments in forms other than cash. PIK payments are typically made by either deferring the interest payment (increasing the amount of debt) or by issuing additional equity securities (such as stock options warrants, shares, or preferred stock) to compensate for the interest. The PIK loan enables the debtor to borrow without having the burden of a cash repayment of interest until the loan term is ended. PIK loans are commonly used in leveraged buyout (LBO) transactions typically funded by private (direct) lenders.

PIK interest can be structured in several ways:

· Full PIK: PIK interest represents the entirety of the interest payable.

· Split PIK: PIK interest represents only a portion of the interest payable, with the remainder in cash.

· Toggle PIK, where the borrower has the option to switch between cash and PIK interest if certain conditions are satisfied.

PIK Payments Increase Risk

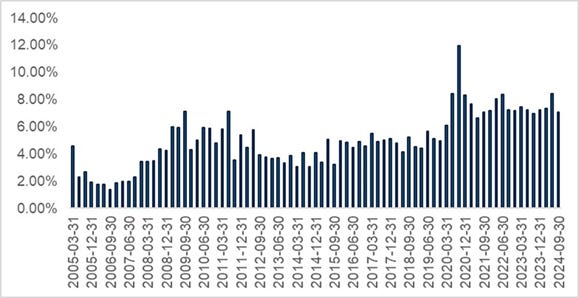

As interest accrues, and is added to the principal, the debt burden grows, potentially leading to higher leverage ratios and increased financial risk. With the rise in benchmark interest rates that began in 2022, borrowers have sought ways to manage rising funding costs. As the use of PIK has increased, the ability of borrowers to capitalize all (or a portion) of their interest expense has raised red flags about credit risk and the true quality of the borrower. The chart below (from Cliffwater) shows that the percentage of PIK income as a percent of total income for the Cliffwater Corporate Direct Lending Index (an asset-weighted index of directly originated middle market loans) has been increasing since the great financial crisis.

CDLI PIK as Percent of Total Income

Given the increased risks created by PIK, it is important to distinguish between loans where the PIK amendment is made later in the life of the loan (typically because the borrower is in distress) and those that are made in the original loan documents (referred to as a PIK toggle). For example, high-growth companies with solid long-term prospects may prefer to have the flexibility to use PIK to free up cash for investment, believing that future returns will outstrip the additional debt burden.

In recognition of the incremental risks associated with granting the right to use PIK, lenders won’t typically provide a borrower with a PIK toggle unless the borrower has demonstrated strong financial health and pro-forma growth plans. And when they do offer toggles, lenders require compensation for the increased risks. The compensation can be in the form of a higher origination fees, higher credit spreads, and/or stronger covenants. Examples of PIK toggle premiums are:

· A flat premium (e.g. a 25 basis points per annum increase to the credit spread over the benchmark rate.

· A cumulating premium of x basis points per 100 basis points of margin PIK’d (for example, 25 basis points per annum for each 100 basis points of margin converted into PIK margin).

· A tiered premium construct whereby a given flat premium applies if less than a certain percentage of the cash margin is PIK’d, and a greater premium applies if more than such predefined percentage is PIK’d (for example, 25 basis points per annum if PIK interest is equal to or less than 200 basis points and 50 basis points if PIK interest is greater than 200 basis points).

in many cases there remains a minimum portion of the margin that must be paid in cash – often between 3% and 4% per annum. Lenders might also require limitations on the total number of months or financial quarters during which interest can be PIK’d (for example, a maximum of six quarters) or to limit both the total number of months or financial quarters as well as the number of consecutive months or quarters (for example, a maximum of six quarters, with no PIK toggle in consecutive quarters).

Lenders are also likely to negotiate the duration of PIK availability periods to prevent excessive principal growth. For example, the PIK availability period might have a fixed duration cap, perhaps between six and 24 months. PIK availability might also be tied to a financial or business milestone (such as a few months after the approval of a key drug or the launch of a new product or the creation of material customer contracts), aligning the PIK availability period with the anticipated value creation events. And PIK toggle features can also be tied to performance metrics to allow borrowers to switch between PIK interest and cash based on predefined performance metrics.

Lenders may also incorporate triggers that automatically require borrowers to discontinue PIK interest and resume making cash interest payments—incorporating mandatory return to cash pay triggers. These triggers allow a lender to benefit from improved borrower performance, and may include:

· A liquidity event, such as where an equity financing round exceeds a specified dollar threshold.

· Achievement of revenue milestones for one or more periods.

· Maintenance of a minimum cash balance for one or more periods.

Given the differences in risks between loans that have PIK amendments when borrowers become distressed and loans that have PIK toggles negotiated upfront, it is important for investors to perform due diligence on a fund’s holdings, drilling down to determine the percentage of loans in each of the categories. I have been an investor in Cliffwater’s Corporate Lending Fund (CCLFX) almost from inception because of their focus on credit quality as opposed to yield. As of September 2024, Cliffwater reported that PIK Income as a percent of total income for their CDLI index was 7.0%, for their CDLI-S index (senior only loans) it was 3.8%, and for CCLFX it was just 2.0%.

Within the co-investment portfolio of CCLFX, they track PIK in two separate ways to discern between borrowers that are showing indicators of impairment or not. The less risky “loans with PIK toggles” constituted 9.2% of the portfolio while the riskier “loans amended to PIK” constituted just 1.3% of the portfolio. It’s worth noting that historically Cliffwater has found that, on average, borrowers with a PIK toggle in their portfolio have posted stronger EBITDA and revenue growth versus borrowers with cash-pay only interest payments.

PIK Amendments

It’s also important to note that when loans that are amended to include PIK the lender will renegotiate the terms of the loan. In return, they will demand some form of compensation which typically includes additional covenants and often will require an equity infusion from the private equity sponsor.

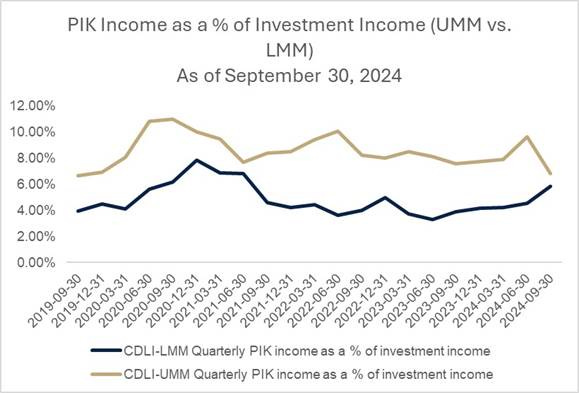

PIK Income by Market Segment: Upper-Middle Market (UMM) vs. Lower-Middle Market (LMM)

A common assumption in private debt is that smaller companies (lower middle market) would be more reliant on PIK income than their larger counterparts. However, data from Cliffwater’s indices shows that that upper middle market loans (CDLI-UMM) have historically exhibited higher PIK levels than lower middle market loans (CDLI-LMM).

“This counterintuitive result may stem from structural differences in lending dynamics: while larger companies often have greater negotiating power and access to flexible capital structures, lenders may also view them as stronger credits with more predictable cash flows. As a result, lenders are more willing to offer PIK toggles to UMM borrowers. Conversely, smaller borrowers in the LMM segment may face greater absolute risk in the eyes of lenders as they are typically more vulnerable to economic shocks. Given these factors, lenders may be less willing to offer PIK provisions to LMM borrowers.”1

Investor Takeaways

PIK loans can provide short-term financial relief for companies facing liquidity challenges, but they introduce significant long-term risks. For investors and fund managers, navigating the PIK landscape requires a cautious and informed approach, differentiating between strategic use and financial distress-driven reliance on PIK loans. PIK income exemplifies the complexity and nuance of private debt investing—while it offers the potential for higher yields and greater borrower flexibility, it demands rigorous analysis and prudent portfolio management. In the hands of disciplined lenders, PIK can be a useful tool—but it’s not without its drawbacks.”2 Thus, careful due diligence is required before investing.

1. “PIK and Choose: The Pros and Cons of Deferred Income in Direct Lending” Cliffwater (February 2025)

2. Ibid.