The Hidden Risks of Leveraged and Inverse ETFs

Exchange-traded funds (ETFs) have revolutionized investing by offering low-cost, diversified exposure to various asset classes and investment strategies. However, a subset of these products—leveraged and inverse ETFs—which, through the use of options or derivates—allow investors to obtain levered (typically 2x or 3x) exposure or inverse exposure (typically -1x, -2x, or -3x) to an index or an underlying asset class—present unique challenges that many investors don't fully understand. Research examining the risk/return characteristics of US-based equity leveraged and inverse ETFs reveals critical insights that every investor should know before considering these complex instruments.

Srinidhi Kanuri and James Malm, authors of the study “An Update on Risk/Return Analysis of US-Based Equity Leveraged and Inverse ETFs,” published in the Summer 2025 issue of The Journal of Beta Investment Strategies, evaluated the absolute- and risk-adjusted performance of 114 US-based equity leveraged and inverse ETFs from July 2006 to April 2023 and compared them to the total US market ETF SPY. They also computed their CAPM and four-factor alphas. Following is a summary of their key findings:

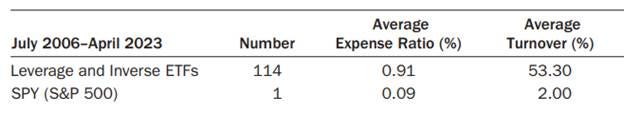

Turnover and Expenses: Equity leveraged and inverse ETFs are very expensive and have a very high turnover.

Daily Objectives vs. Long-Term Performance

The research confirms what many academic studies have established: leveraged and inverse ETFs are designed to meet their objectives on a daily basis only. However, over longer periods, the daily rebalancing required to maintain leverage can lead to significant performance deviations from what investors might expect.

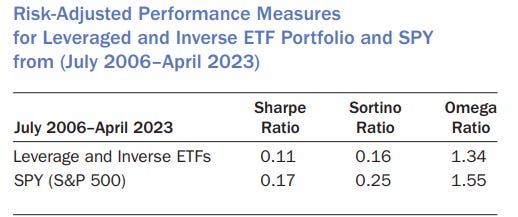

· Sharpe ratios, and other risk-adjusted return metrics were lower for the leveraged and inverse ETFs.

· Alphas were statistically negative (at the 1% confidence level) with both the CAPM (-0.62% per month) and the Carhart four-factor (beta, size, value, and momentum) models (-0.50% per month).

Their findings led Kanuri and Malm to conclude: “We find that equity leveraged and inverse ETFs are very expensive and have a very high turnover. They also have higher risk and returns than SPY. Alpha was statistically negative with both the CAPM and the Carhart four-factor models…. All these results indicate that leveraged and inverse ETFs are extremely high-risk investments and are not at all suitable for retail investors.”

Key Investor Takeaways

Understand the "Daily Reset" Reality

The most crucial takeaway is that leveraged and inverse ETFs reset their leverage daily. This means they're designed for short-term tactical trades, not long-term investments. Investors who hold these products for extended periods are likely to experience returns that significantly differ from their expectations.

Volatility Is Your Enemy

High market volatility can be particularly damaging to leveraged ETF performance. Even if you correctly predict the direction of market movement, excessive volatility can erode returns through the compounding effect—the tendency for leveraged ETFs to lose value over time in volatile, sideways markets. When markets experience high volatility without a clear directional trend, the mathematical effects of daily compounding can erode returns for higher-leverage products.

The Bottom Line for Retail Investors

The research reinforces that while leveraged and inverse ETFs are specialized tools that can serve specific tactical purposes, they're not appropriate for individual investor portfolios. The daily reset mechanism, volatility decay, and compounding effects create risks that may not be immediately apparent.

For investors attracted to these products' potential for amplified returns, it's essential to understand that they come with amplified risks and complexity. The research suggests that investors would be better served by traditional ETFs combined with appropriate position sizing to achieve their desired risk exposure.

Summary

The analysis of US-based equity leveraged and inverse ETFs reveals a complex landscape where marketing promises don't always align with real-world performance. While these products successfully achieve their daily objectives, their long-term performance can deviate significantly from investor expectations due to mathematical realities of daily compounding and volatility decay.

The key insights from this research are clear: these products are not suitable for buy-and-hold strategies nor for investors who don't fully understand their mechanics. The research serves as a crucial reminder that in investing, complexity can come with hidden costs and unexpected risks.

The financial industry continues to innovate with new products, but this research reminds us that fundamental investment principles—understanding what you own, matching investments to time horizons, and maintaining appropriate risk levels—remain as important as ever in navigating these complex instruments.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest Enrich Your Future. He is also a consultant to RIAs as an educator on investment strategies.