The Overvalued Dollar: What a Reversal Could Mean for Global Equities

For the past three decades, the US dollar and American stock market performance have been closely linked, with periods of dollar strength typically coinciding with US equity outperformance. However, 2025 has marked a significant shift: the dollar’s rally has reversed, and international equities are beginning to benefit from this new dynamic

Despite this year’s decline, the US dollar remains notably overvalued by traditional measures. Purchasing Power Parity (PPP) models estimate the dollar is still about 15% above its fair value as of early 2025.

IMF data shows the US dollar even more overweighted. Against key developed markets, the US dollar 2023 overvaluation was 21%. But for leading EM nations it was 109%, driven by their need to maintain trade competitiveness.

Another risk for the dollar is that the consensus expects inflation to rise in the US and fall in the eurozone (see chart below). This divergence in inflation increases the likelihood of continued dollar weakness.

Structural and Cyclical Drivers

Much of the dollar’s persistent overvaluation is structural, rooted in its status as the world’s primary reserve currency. This has created ongoing demand for dollars, keeping its value elevated even when fundamentals would suggest otherwise. However, this reserve status is now facing new challenges: rising US deficits, policy uncertainty, and growing efforts by central banks to diversify their reserves are all contributing to a reassessment of the dollar’s role in the global system.

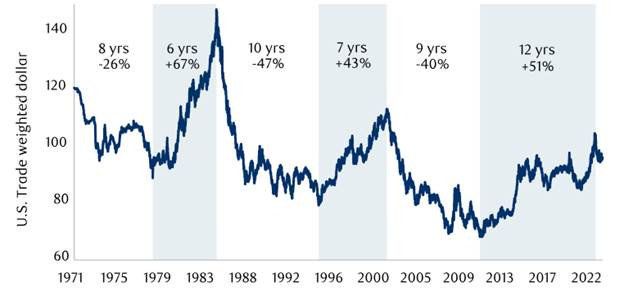

History shows that the dollar moves in multi-year cycles, with periods of strength followed by prolonged declines. Since the 1970s, these cycles have averaged about 7–8 years each. See chart below.

What a Dollar Decline Could Mean for Global Equities

Historically, a weaker dollar has been a tailwind for international equities. When the dollar depreciates, foreign earnings translate into higher returns for US-based investors, and capital tends to flow into non-US markets. When the dollar has been extremely overvalued on the IMF’s PPP data, the Fed’s trade-weighted index has tended to decline over the next five years at an average pace of 4.5% per year. Should that occur it would provide a tailwind to foreign equities.

Recent market behavior underscores this point: as the dollar weakened in early 2025, European equities saw their strongest foreign inflows in a decade, and emerging market assets began to outperform. If the current cycle continues, investors with diversified global portfolios may be well-positioned to benefit from this shift.

Conclusion

The US dollar remains historically overvalued, even after its recent reversal. Structural factors, cyclical trends, and shifting macroeconomic risks all point toward the potential for further declines in the coming years. Investors with underweight to international equities either due to home country, or recency, bias might want to reconsider that underweight.