Valuation Discipline in Private Credit

There are several features of private credit that can cause investors to have concerns about valuation practices.

· Private creditors typically engage in direct origination of loans without bank syndication. These loans are rarely traded, making them illiquid level three assets—considered to be the most illiquid and hardest to value.

· Valuations of level three assets are typically performed using a combination of complex market prices, mathematical models, and subjective assumptions.

· Borrowers are primarily private middle-market firms that are not subject to reporting regulations.

· Tender-offer and closed-end funds that do not provide daily NAVs, typically provide valuations either monthly or quarterly. The result is that reported valuations may reflect market corrections with a lag, creating serial correlation of returns which leads to an understating of a fund’s true volatility.

In theory, delegating to a third party could be a way to produce unbiased valuation and mitigate concerns about agency frictions. However, third party appraisers are usually appointed and compensated by private creditors themselves, creating the potential for incentives to provide valuations clients seek.

To test the theory, Young Soo Jang and Ginha Kim, authors of the February 2025 study “Valuation Discipline in Private Credit,” examined the role of third party appraisal in private credit markets. They began by noting: “While not mandated, the use of third-party appraisal is quite prevalent, where creditors of private creditors themselves often require such intermediation.” Preqin and PitchBook were the main sources of their data for private credit which covered the period 2014 Q3-2023 Q4.

Jang and Kim chose to focus most of their analysis on business development companies (BDCs) because they are required to make quarterly SEC filings, allowing them to compare public reporting with third party recommendations. Nineteen of top 25 US private credit fund managers and 98 of 173 BDCs were in their database (lender-wise) and 32% (53%) of private credit borrowers (with disclosed loan terms) in Pitchbook also appeared. Relative to the universe, their sample represents bigger direct lenders with more BDCs (lender-wise) and more PE-backed firms with level-3 loans (borrower-wise). Following is a summary of their key findings:

· While not mandated, the use of third-party appraisal was prevalent; at least 76% of BDCs used them.

· 58% of BDCs were required by their own creditors to use third party appraisals, explicitly writing this in their credit agreements.

· Older, larger, and more levered BDCs were more likely to use third-party valuation.

· Due to the high cost of appraisals, among BDCs using third-party appraisers, only about one-fifth of loans were appraised each quarter, on average—thus, results could be affected by selection effects from specific loans chosen to be appraised in each quarter.

· Third-party appraised loans exhibited lower serial correlation in fair value updates, suggesting that appraisals have a disciplinary effect.

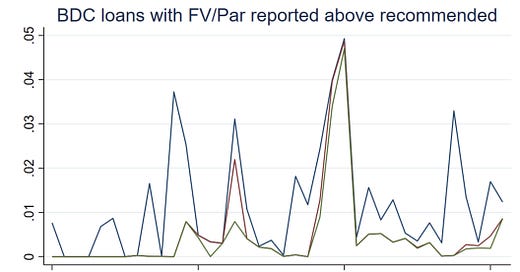

· Private creditors’ reporting of loan fair values rarely deviated (just a few percent) from third party recommendations—with a notable exception during the COVID-19 period. The chart reports the fraction of appraised BDC first-lien loans whose reported values exceeded their appraised values by more than 1, 3, and 5 percentage points of par.)

· During COVID, lead lenders deviated less as they received higher appraisals, which was not driven by differences in valuation methodologies or the timing of financial statement delivery. Instead, analyses of cross-held loans show that lead lenders likely incorporate more information negotiated in the credit documents into their valuations, especially soft information acquired through distressed renegotiations. Thus, information asymmetry in lending relationships can contribute to dispersion in reported marks, beyond often cited agency reasons.

· Appraisers did not give preferential treatment across clients. Within loans jointly held by different clients, the third-party appraiser was not likely to give different valuations based on the length of client relationship.

Their findings led Jang and Kim to conclude: “All together, third party valuation appears to be a widely used governing tool in private credit, most often imposed by their own investors or creditors. However, they do not always provide the best assessment, as their effectiveness varies with differences in information. A key takeaway is that dispersion in pricing of the same loans can also be driven by information asymmetry across lending relationships. This provides evidence against the view that divergence in reported fair values are entirely due to shortcomings of mark-to-model methods or agency frictions.”

Investor Takeaways

Jang’s and Kim’s findings demonstrate that the use of third-party appraisals should be a requirement for investors considering an allocation to private credit funds. Their findings also suggest that investors are best served by allocating to larger funds that have sufficient economies of scale to pay for broader appraisal coverage. Their findings also demonstrate that the use of third-party appraisals also reduces the risk of serial correlation which can lead to an understating of a fund’s volatility.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest Enrich Your Future.