Why Cliffwater Was My Choice for Private Credit

The private credit market has grown rapidly since the great financial crisis of 2007-2008, exceeding $2 trillion by 2024, about three-quarters of which was in the US where its market share approached that of syndicated loans and high-yield bonds. I have written extensively (for example, see here, here, here, and here) on the benefits/issues related to investing in private credit private credit, noting that my preferred vehicles are the funds managed by Cliffwater. Given the proliferation of private credit vehicles, investors face a complex landscape when choosing among fund managers. My preferred choice is Cliffwater, and here’s why.

Private Credit: A Persistent and Diversified Premium

A core tenet of sound investing is recognizing that markets are highly, though not perfectly, efficient. As such, investors should seek exposure to unique sources of risk that have demonstrated a persistent premium—one that is robust across economic cycles, sectors, and geographies, is implementable after fees and costs, and has a logical rationale for its existence. Private credit fits these criteria, offering a return premium for bearing economic cycle (credit) risk and illiquidity risk.

Why Diversification and Beta Matter

Given the efficiency of markets, investors should focus on broad, diversified exposure to minimize idiosyncratic (manager-specific or company-specific) risk. The objective is to capture the “beta” of the private credit asset class, earning compensation for credit and illiquidity risks, rather than chasing alpha through concentrated bets (as an interval fund CCLFX is only required to redeem 5% of its NAV each quarter). The Cliffwater Corporate Lending Fund (CCLFX) exemplifies this approach.

· It has about $28 billion of assets under management as of April 2025.

· Its portfolio contains more than 3,800 loans.

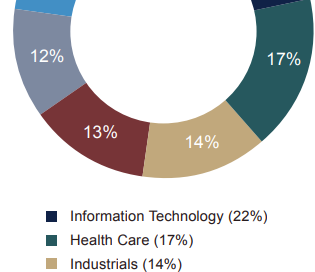

· It has a minimal concentration of holdings.

· Its holdings are highly diversified by industry.

Risk Management: Seniority, Security, and Structure

While seeking exposure to private credit, it’s crucial to minimize additional risks that may already be present in other parts of a portfolio, such as equity market risk or interest rate/inflation risk. CCLFX achieves this by focusing on:

· 96% of the portfolio has a first lien position.

· 98% of the loans are floating rate (minimizing inflation/duration risk).

· The average loan-to-value was just 41%, adding a margin of safety.

· 97% of the loans are made to borrowers sponsored by private equity.

· Loans are made to profitable companies with the average (median) EBITDA (earnings before interest, taxes, depreciation, and amortization) of $106.3 million ($71.9 million).

· At 0.53x the fund’s use of leverage is only about one-half of that of lenders in the Cliffwater Direct Lending Index (CDLI).

Manager Selection: Experience and Access Matter

While recognizing that public markets are highly efficient (there is no evidence of persistence in performance in public markets), there is evidence of persistence in performance in private markets. For example, the authors of the 2022 study “Private Debt Fund Returns, Persistence, and Market Conditions,” found “performance persistence across funds managed by the same general partner.” Importantly, there has also been a wide dispersion of outcomes between top and bottom quartile managers. Thus, you want a fund manager who has: long experience in the asset class, access to top quartile lenders, and access to their co-investments which make up about 66% of the fund as of the end of May, 2025 (and are made without any additional layer of fund expenses). And by diversifying across a number of the top quartile managers (where the dispersion of returns is relatively low), you increase portfolio diversification and minimize manager risk. With more than 20 years of experience as a consultant on pension plans and endowments on private market investments, and the creator of the CDLI (Cliffwater Direct Lending Index), Cliffwater stands out on these fronts.

Liquidity & Liability Management: Meeting Redemption Needs

For interval funds like CCLFX, liquidity management is critical. The fund’s robust approach includes:

$12.1 billion in debt commitments raised since inception through April 2025.

More than 70 unique financing relationships.

The largest issuer of US private placement notes in 2022, 2023, and 2024.

Over $5 billion in immediately available liquidity as of April 2025, the highest percentage relative to NAV among peers.

Available Liquidity as % of NAV vs. Peers

Cost Efficiency: Lower Fees, Higher Net Returns

Fees are a major drag on private credit returns. Cliffwater’s 2025 survey of private credit fund sponsors covered 68 firms managing over $1.3 trillion in direct lending assets. It found:

· Effective management fees averaged 1.78%, carried interest fees averaged 1.58%, and administrative expenses averaged 0.45%, for a total cost of 3.81%.

· Total fees as a percentage of NAV varied widely from a low of 2.91% (10th percentile)

to a high of 5.01% (90th percentile) with the variances explained by differences in management fee rates, whether management fees are charged on net or gross assets, and the degree of leverage.

CCLFX has an effective management fee (based on NAV) estimated at 1.00%, no carried interest expense, acquired fund fees and expenses estimated at 0.31%, and other expenses estimated at 0.23%, for a total expense (excluding interest on borrowed funds) of 1.58%—2.23% below that of the average lender, and 1.33% below the fee of the 10th percentile of lowest fees.

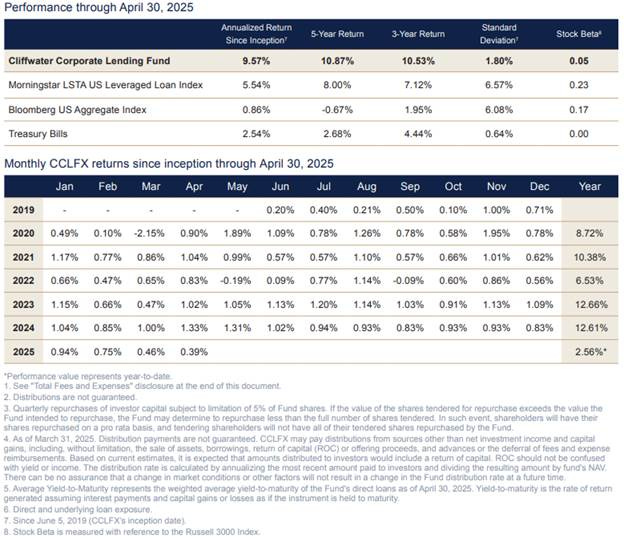

Performance Summary

The following is a summary of the fund’s performance since inception.

The fund returned 1.13% in May, bringing 2025 year-to-date returns to 3.72%. The fund’s performance since its June 2019 inception has been strong and consistent, reflecting its disciplined approach.

Summary: Why CCLFX Stands Out

Cliffwater’s CCLFX is my preferred vehicle for private credit exposure because it offers:

Exceptional diversification across managers, industries, and borrowers.

High credit standards and prudent risk management.

Low expenses relative to industry peers.

Conservative use of leverage.

A strong focus on liquidity management.

These factors combined deliver a well-constructed, cost-efficient, and resilient private credit investment.

Postscript

The same evidence on persistence of performance of private credit funds has been found in private equity (see here). Thus, the same criteria described above should be used when selecting a manager to access the asset class of private equity. Considerations should be to minimize idiosyncratic risk through broad diversification across managers, sectors, and countries, while providing access to top quartile managers who also provide access to co-investments and secondaries. And of course, fees and expenses should be considered.