Why Cliffwater’s CPEFX Is My Choice for Private Equity Exposure

Private Equity: A Persistent and Diversified Premium

A core tenet of sound investing is recognizing that markets are highly, though not perfectly, efficient. As such, investors should seek exposure to unique sources of risk that have demonstrated a persistent premium—one that is robust across economic cycles, sectors, and geographies, is implementable after fees and costs, and has a logical rationale for its existence. Private equity fits these criteria, offering a return premium for bearing economic cycle risk and illiquidity risk.

Historical Long-Term Outperformance

The January 2025 Cliffwater study, “Long-Term Private Equity Performance 2000-2024,” represents one of the most comprehensive long-term performance studies of private equity, drawing from actual institutional allocations rather than fund-level reporting. It found that the private equity allocations of state pension funds delivered exceptional results over the 24 years ending June 30, 2024.

· 10.7% net-of-fee annualized return.

4.1% annual outperformance versus a comparable public equity portfolio (70% Russell 3000, 30% MSCI ACWI ex-US).

90%+ outperformance rate on a five-year rolling basis.

Further Evidence

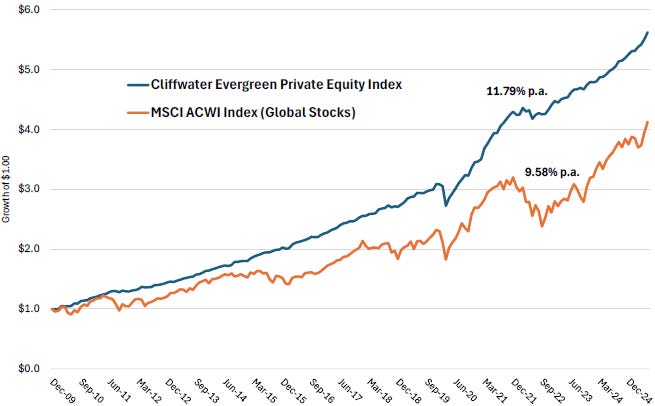

In 2025, Cliffwater introduced the Cliffwater Private Equity Index. It is the first to track the performance of retail-focused evergreen private equity funds, providing monthly returns for an asset-weighted composite of 29 funds meeting certain eligibility requirements, collectively holding $65 billion in net assets as of June 30, 2025, and with history back to December 31, 2009. The chart below reports cumulative returns for the 15.5-year history of the CEPEI and the MSCI ACWI from December 31, 2009 (inception of the CEPEI) through June 30, 2025. Over the full period, the CEPEI delivered approximately 2.2% annual outperformance versus the MSCI ACWI.

Wide Dispersion of PE Returns

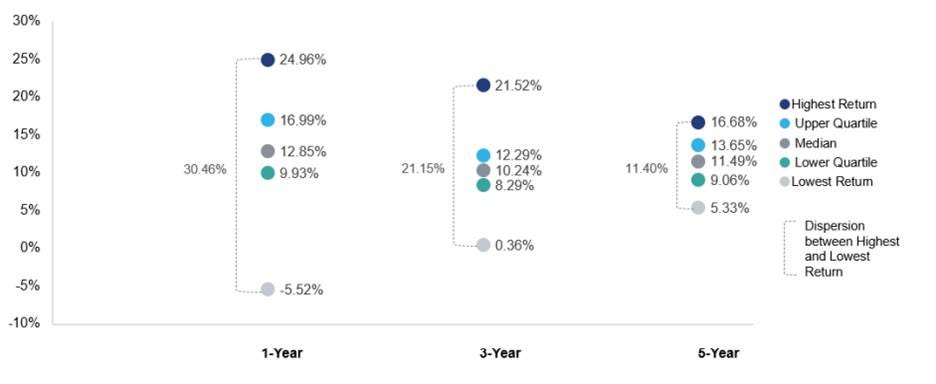

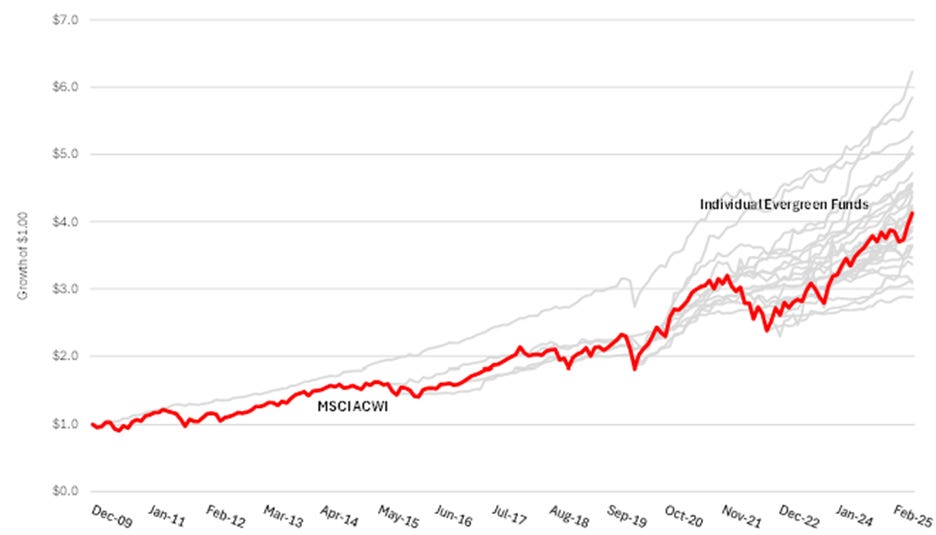

Because the volatility of individual private equity investments is dramatically higher than in public markets, private equity experiences a wider dispersion of fund returns, increasing the importance of manager selection, diversification, and the deep level of diligence allocators must undertake when evaluating the opportunity set in this asset class. The table below presents the dispersion of returns among the evergreen PE funds within the CEPEI over the last one, three, and five years (there is a limited sample size of funds beyond that), and the chart following covers the full sample period. Together they provide a strong signal that fund selection is as critical to successful outcomes in evergreen funds as it is in drawdown funds:

Top quartile substantially outperforming benchmarks.

Bottom quartile significantly underperforming.

Individual fund performance ranging from +13% to -12% annually versus MSCI ACWI.

Evergreen Private Equity Fund Performance Dispersion (annualized time-weighted returns as of June 30, 2025)

Source: Cliffwater Research: “Evergreen Private Equity for the Long Run” (September 2025)

Individual Evergreen Private Equity Fund Performance Compared to MSCI ACWI

Source: Cliffwater Research: “Introducing the Cliffwater Evergreen Private Equity Index” (September 2025)

Performance Persistence: A Unique Asset Class Characteristic